1. Abstract

This article explores the concepts of alpha and beta in algorithmic trading, with an emphasis on how investors and algorithmic systems distinguish between outperforming strategies and safer market exposure. Alpha strategies are designed to generate returns above the market average, while beta strategies aim for market-matching performance with lower risk. We examine these concepts in depth, including their theoretical underpinnings and real-world application, particularly through the lens of Jim Simons and Renaissance Technologies. All insights are grounded in peer-reviewed academic literature and financial theory.

2. Beta: Systematic Risk and Passive Exposure

2.1 Definition of Beta

In the CAPM framework, beta (β) represents an investment's sensitivity to market movements. A beta of 1.0 means the investment moves in tandem with the market; higher than 1.0 implies greater volatility, while less than 1.0 indicates less volatility.

2.2 Beta as Safe Investment

A beta strategy involves investing in broad, diversified indices like the S&P 500, FTSE 100, or government-backed securities, such as U.S. Treasury bonds or sovereign wealth funds. These assets are considered “safe” because they offer long-term exposure to economic growth with lower unsystematic risk.

“Beta represents exposure to systematic market risk, which cannot be diversified away. It is the return derived from simply being invested in the market.”

— Bodie, Kane, & Marcus, Investments (11th Edition)

Beta is passive in nature—it does not attempt to beat the market but instead seeks to match it. Algorithmic trading systems focused on beta might include index tracking algorithms, ETF rotation models, or risk-parity portfolios.

3. Alpha: Excess Return through Strategy and Insight

3.1 Definition of Alpha

Alpha (α) refers to the portion of an investment's return that exceeds the return predicted by beta exposure alone. It is a measure of skill, insight, or access to superior information.

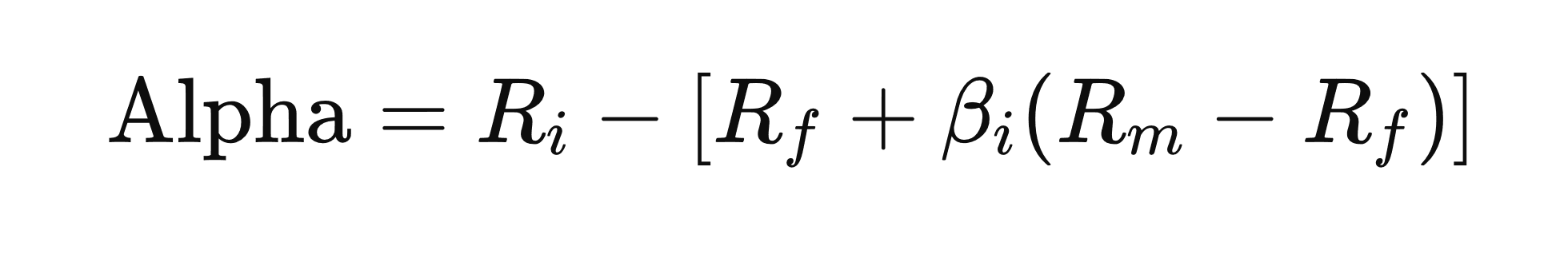

In a quantitative framework:

Ri: actual return of the investment

Rf: risk-free rate

Rm: return of the market

3.2 Alpha in Algorithmic Trading

Alpha is the “holy grail” in hedge funds and quant finance. Generating consistent alpha requires sophisticated data analysis, pattern recognition, and market inefficiency exploitation—traits famously exemplified by Jim Simons.

“We look at huge amounts of data. We don’t have any preconceived ideas. We look for anomalies.”

— Jim Simons, quoted in Zuckerman, The Man Who Solved the Market (2019)

Alpha-generating strategies include:

Statistical Arbitrage: exploiting mean-reverting relationships between asset pairs.

Event-driven strategies: trading based on anticipated market reactions to earnings reports, mergers, etc.

Machine Learning: models that detect nonlinear patterns invisible to traditional methods.

Alternative data: using satellite imagery, credit card data, or social media sentiment to anticipate market moves.

4. Combining Alpha and Beta in Practice

A growing number of institutional investors use a “core-satellite” approach to blend beta and alpha:

Core (Beta): Bulk of capital allocated to passive index funds, ETFs, or low-risk government assets.

Satellite (Alpha): Smaller portion deployed in active, algorithmic strategies aimed at excess return.

This diversification reduces risk while enabling performance enhancement.

Risk Management

One of the benefits of separating alpha and beta is improved risk budgeting. Investors can more clearly understand which returns stem from market exposure (beta) versus those earned through strategy (alpha).

“Separating alpha from beta allows investors to pay only for skill, not market exposure.”

— Sharpe, W. F. (1992), The Arithmetic of Active Management, Financial Analysts Journal

5. Jim Simons: A Case Study in Alpha Extraction

Jim Simons’ Medallion Fund is perhaps the most successful example of a persistent alpha-generating strategy. The fund used short-term, high-frequency trading algorithms that captured pricing inefficiencies across global markets.

Simons' team included mathematicians, physicists, and computer scientists rather than traditional finance professionals. They applied nonlinear time-series analysis, signal processing, and Bayesian inference to build strategies that worked across decades.

“Renaissance’s success stems from identifying statistical relationships using large data sets—harvesting alpha from noise.”

— Zuckerman, The Man Who Solved the Market (2019)

6. Conclusion

In summary, beta strategies provide essential exposure to the broad market and are central to low-risk investment. In contrast, alpha strategies attempt to outperform the market by exploiting inefficiencies and leveraging predictive analytics. In the age of algorithmic trading, the distinction between these two becomes increasingly crucial—not only for measuring performance but for managing risk and capital allocation.

Jim Simons' success highlights the extreme end of what alpha can deliver when supported by advanced technology, massive data, and mathematical precision.

References

Bodie, Z., Kane, A., & Marcus, A. J. (2021). Investments (11th Edition). McGraw-Hill Education.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Lo, A. W., & Hasanhodzic, J. (2007). The Evolution of Technical Analysis: Financial Prediction from Babylonian Tablets to Bloomberg Terminals. Financial Analysts Journal, 63(2), 18-26.

Sharpe, W. F. (1992). The Arithmetic of Active Management. Financial Analysts Journal, 47(1), 7–9.

Zuckerman, G. (2019). The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution. Penguin Books.